ETH value is stuck in a exceedingly|in a very} rut and these 3 metrics recommend the downtrend is obscurity close to an finish.

Ether (ETH) is still in troubled waters once failing to interrupt a five-week-long downward channel high for the third time in a very row. The March 2 check of the $3,000 resistance was followed by a seventeen.5% correction in 5 days, that signals that consumers are somewhat reluctant to defend the value.

To date, Ether suffers from high network dealing fees, despite the fact that it born from $19 in mid-February to this $13 per dealing. whereas this is often but peaks seen antecedently, $13 per dealing remains incompatible with most games, nonfungible token and even decentralised finance transactions.

Even additional worrisome than Ether's performance has been the total value locked (TVL) in Ethereum declining by fifty fifth on March 8. information shows the proportion of assets fastened in its sensible contracts reached an rock bottom versus competitors.

This indicator may part make a case for why Ether has been during a down-trend since early Feb. But, additional significantly, one has to analyze however skilled traders area unit positioning themselves and there is no higher gauge than derivatives markets.

The futures premium has flatlined

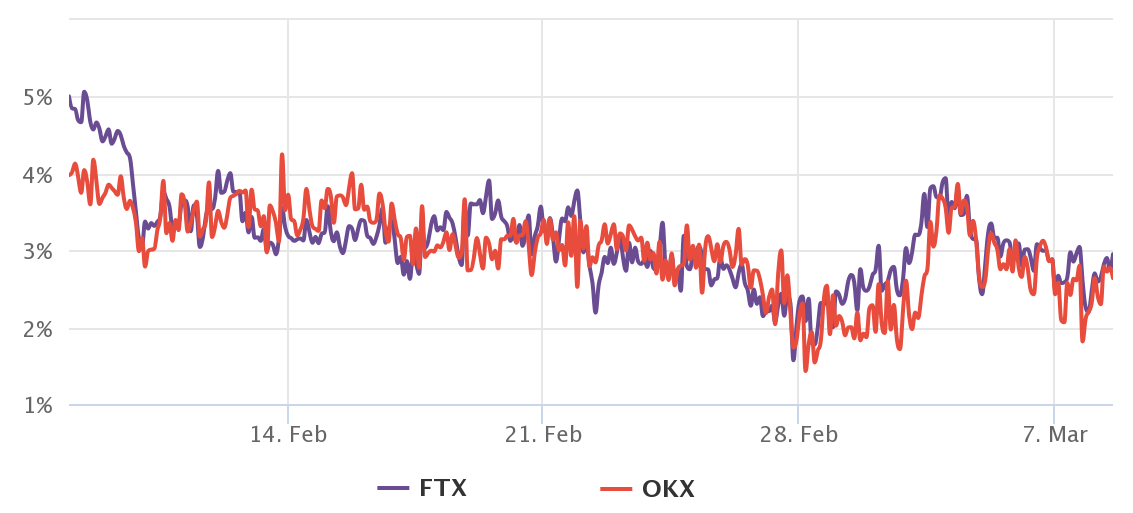

To understand whether or not the present pessimistic trend reflects high traders' sentiment, one ought to analyze Ether’s futures contracts premium, that is additionally referred to as a "basis." not like a perpetual contract, these fixed-calendar futures don't have a funding rate, thus their worth can dissent immensely from regular spot exchanges.

By measuring the expense gap between futures and also the regular commodities market, a monger will gauge the amount of bullishness within the market. Conversely, pessimistic sentiment tends to cause the three-month derivative instrument to trade at a five-hitter or lower annualized premium (basis).

On the opposite hand, a neutral market ought to gift a 5% 15% basis, reflective market participants' temperament to lock in Ether for affordable till the trade settles.

The higher than chart shows that Ether‘s futures premium has copper-bottomed on Feb. 28 near 1.5%, A level generally related to moderate pessimism. Despite the slight improvement to this 3% basis, futures exchange participants are reluctant to open leverage long (buy) positions.

Long-to-short data confirms the lack of excitement

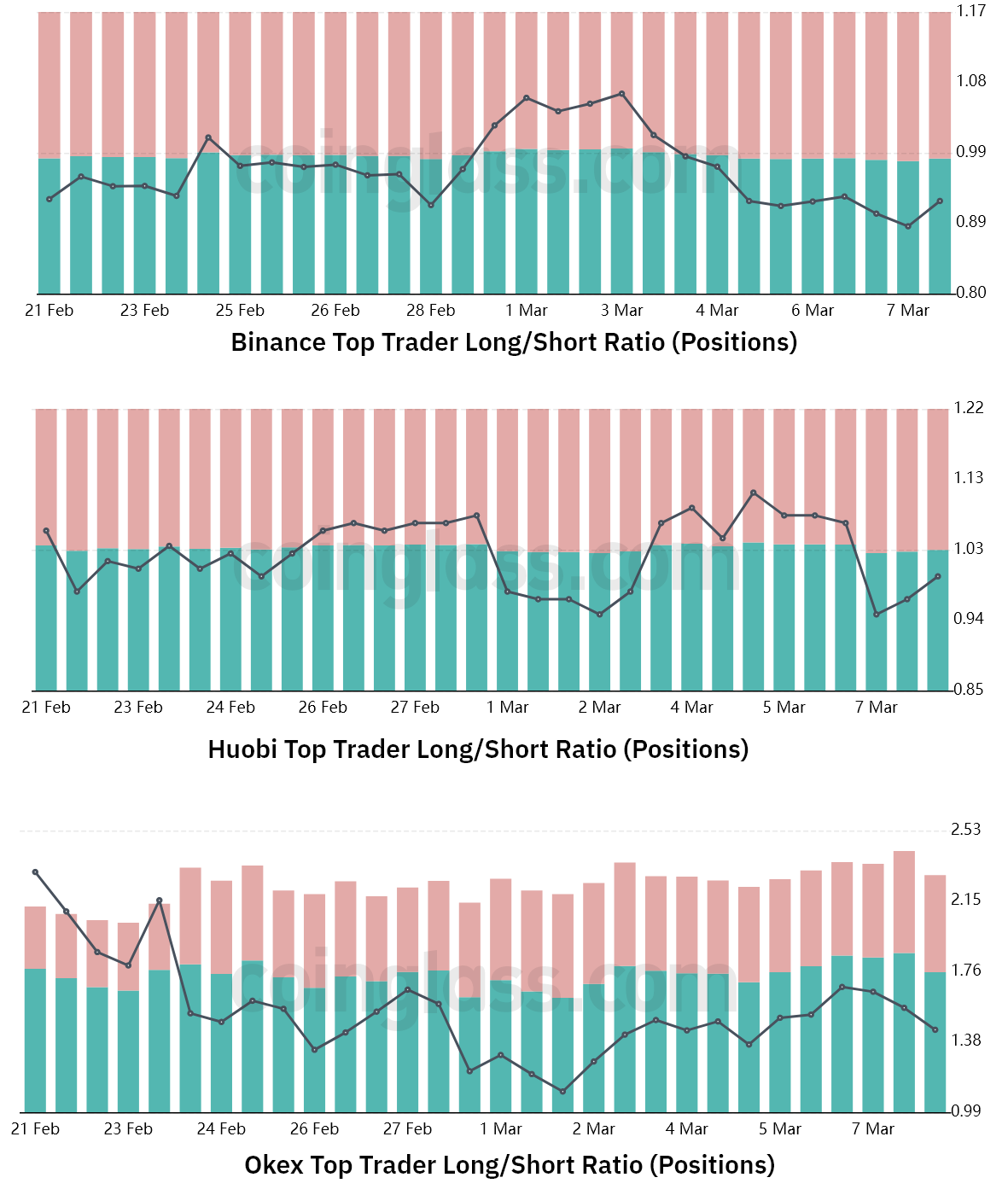

The top traders' long-to-short internet magnitude relation excludes externalities that may have compact the longer-term futures instruments. By analyzing these prime clients' positions on the spot, perpetual and futures contracts, one will higher perceive whether or not skilled traders are leaning optimistic or pessimistic.

There are occasional method discrepancies between completely different exchanges, therefore viewers ought to monitor changes rather than absolute figures.

Curiously, once Ether's futures premium bell-bottom at one.5% on Feb. 28, ETH's value was remarkably about to this $2,600. Thus, it is smart to check the highest traders' long-to-short ratio over this period.

Binance shows a similar level of prime traders Ether positions at 0.92 on Feb. 8 and March 8. However, these whales and market markers at Huobi and OKX effectively reduced their longs. as an example, the long-to-short magnitude relation at Huobi declined from 1.07 to this 1.00. moreover, OKX traders' current 1.47 magnitude relation is smaller than one.58 from eight days past.

All the data points to further downside

From the attitude of the metrics mentioned higher than, there's hardly any sense that Ether worth can flip optimistic within the short-run. the information suggests that professional traders are unwilling to feature long positions, as expressed by the premise rate and long-to-short quantitative relation.

Moreover, the TVL information doesn't back a powerful usage indicator of Ethereum good contracts. Losing ground to competitors, whereas perpetually delaying the migration to a proof-of-stake answer is probably going propulsion investors’ attention away and creating long investors feel uncomfortable.

( Marcel Pechman, Cointelegraph, 2022 )