Technical charts indicate that Bitcoin, XRP, LINK, BCH and FIL may be on the verge of a sharp breakout, but traders are unsure of the direction.

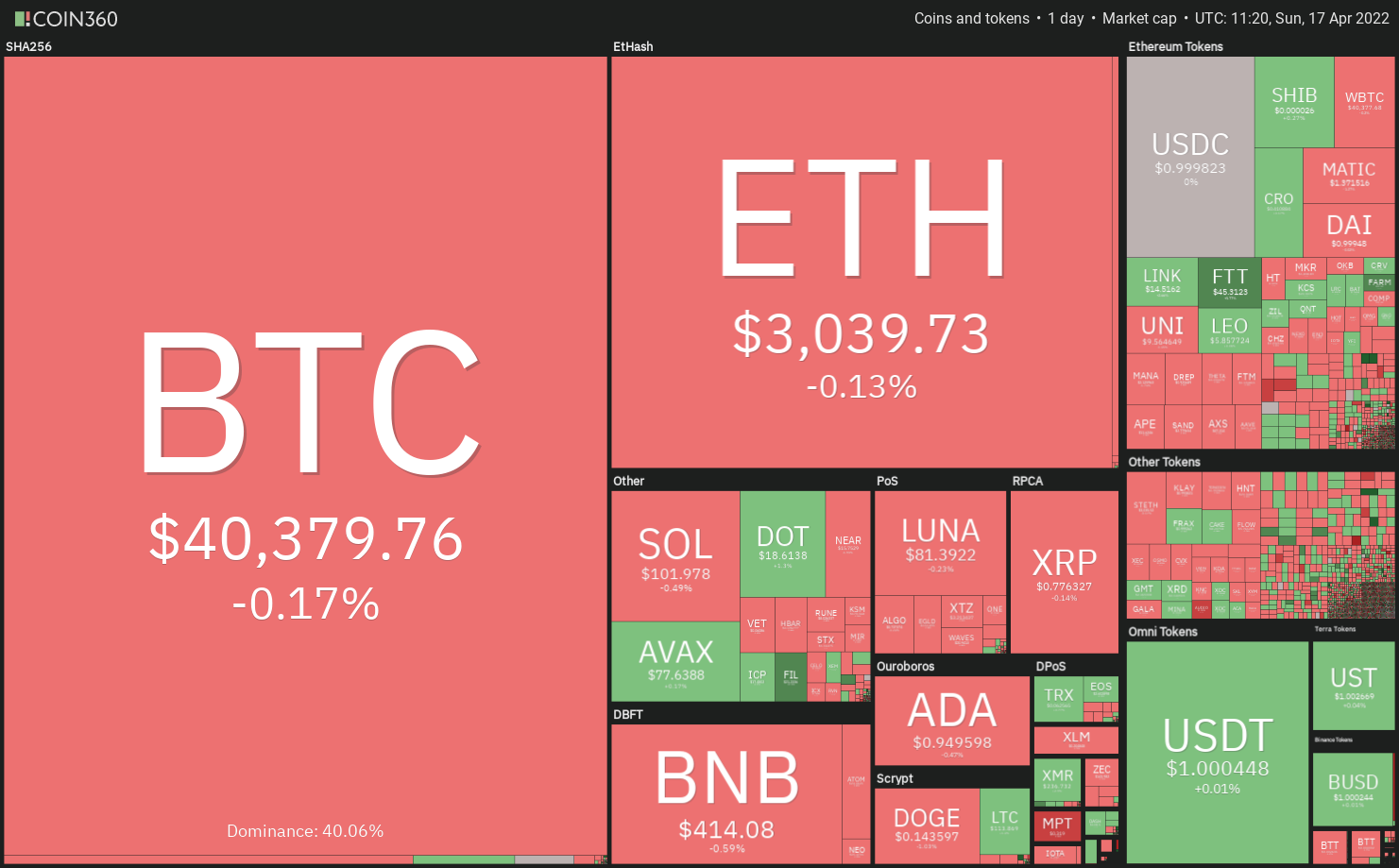

Bitcoin (BTC) and most major altcoins have been relatively quiet during the holiday period from Good Friday onward. This suggests that cryptocurrency traders are not initiating large bets during the period when the U.S. equities markets are closed. That could be because of the tight correlation between Bitcoin and the S&P 500 and the uncertainty about the equity market’s performance in the next week.

While some analysts expect weakness in the near term, others believe that Bitcoin could be in a consolidation phase with a large portion of its upside in the four-year halving cycle yet to come. Josh Olszewicz, head of research at alternative asset management firm Valkyrie, said: “Interesting. Maybe we never got the blow-off top...because it hasn't happened yet."

Although Bitcoin’s price action has been lackluster in the past few days, some altcoins, which found a place in Coinbase’s list of 50 crypto assets under consideration for listing, have witnessed strong trending moves. This suggests that the action has become more coin-specific while the broader crypto market awaits fresh triggers to start a trending move.

Could Bitcoin and select altcoins start a directional move in the next few days? Let’s study the charts of the top-5 cryptocurrencies that may be showing early signs of a recovery.

BTC/USDT

Bitcoin formed an inside-day candlestick pattern on April 16, indicating indecision among the bulls and the bears. Usually, small range days are followed by a range expansion but it is difficult to predict the direction beforehand.

If the price breaks above $41,000 the bulls will attempt to push the BTC/USDT pair above the 20-day exponential moving average ($42,085). If they succeed, the pair could start an up-move to the overhead resistance at the 200-day simple moving average ($48,136) and later to the resistance line of the ascending channel.

The downsloping 20-day EMA and the relative strength index (RSI) in the negative territory indicate a minor advantage to bears.

If the price turns down and breaks below $39,200, the selling could intensify. The pair could then plummet to the support line of the channel. A break and close below this support could extend the decline to $32,917.

The 4-hour chart shows that the price has been clinging to the 20-EMA, indicating that bulls are attempting a comeback. If the price breaks above the overhead resistance between the 50-SMA and $41,561, the pair could rally to the 200-SMA. The bears are expected to mount a strong defense at this level.

This positive view will invalidate in the short term if the price turns down from the current level and breaks below $39,200. The pair could then resume its correction and drop to the strong support at $37,000.

XRP/USDT

Ripple (XRP) rebounded sharply off the strong support at $0.69, indicating strong demand at lower levels. The bulls pushed the price above the 50-day SMA ($0.78) on April 15 but could not continue the up-move. However, a minor positive is that the bulls are attempting to sustain the price above the 20-day EMA ($0.77).

The flat 20-day EMA and the RSI near the midpoint suggest a balance between supply and demand. This balance will shift in favor of the bulls if the XRP/USDT pair rises and breaks above $0.80. That could propel the pair to the 200-day SMA ($0.88) and then to the strong resistance at $0.91.

Contrary to this assumption, if the price breaks and sustains below the 20-day EMA, it will suggest that the bears are active at higher levels. The sellers will then attempt to pull the pair to the strong support at $0.69.

The 4-hour chart shows that the bears are aggressively defending the overhead resistance at the 200-SMA but they have not been able to sink the pair below the 20-EMA. This suggests that bulls are buying on dips.

If the buyers drive the price above the 200-SMA, the bullish momentum could pick up. The pair could then rally to $0.85 where the bears may erect a stiff barrier. On the downside, a break and close below the 20-EMA could invalidate the bullish view in the short term and sink the pair to the 50-SMA.

LINK/USDT

Chainlink rose above the downtrend line on March 30 but the bulls could not sustain the higher levels. Strong selling near $18 pulled the price back below the downtrend line but a minor positive is that the buyers purchased the dip near $13.50 and are attempting to form a higher low.

The first sign of strength will be a break and close above the 20-day EMA ($15). Such a move will suggest that the bears may be losing their grip. The LINK/USDT pair could then rise to $16 and later challenge the overhead resistance at $18. A break and close above this level could open the doors for a possible rally to the 200-day SMA ($21).

Conversely, if the price turns down from the 20-day EMA the bears will attempt to pull the pair to the critical support at $12.50. A break and close below this level could signal the resumption of the downtrend.

The pair has risen above the downtrend line on the 4-hour chart and the 20-EMA and the 50-SMA are on the verge of completing a bullish crossover. This suggests that the bulls are attempting a comeback.

If the price sustains above the 20-EMA, the pair could rally to $16 where the bears may again pose a strong challenge. The bullish momentum could pick up if buyers overcome this barrier.

Alternatively, if the price turns down and breaks below the 20-EMA, it will suggest strong selling at higher levels. The bears will then attempt to pull the pair below $13.50.

( Rakesh Upadhyay, cointelegraph, 2022 )