ETH bears still suppress Ethereum price, however institutional traders’ buying activity and exchanges’ planning to offer more transparency may improve investor sentiment.

Ether value experienced associate 11.9% decline from Nov. 20 to Nov. 22, bottoming at $1,074 — very cheap level seen since July. Currently, investors have reason to be concerned once crypto disposal company Genesis reportedly moon-faced difficulties raising cash, triggering rumors of insolvency on Nov. 21.

However, a exponent for Genesis told that there were no plans for impending bankruptcy as a result of the company continues to carry discussions with its creditors.

Unease regarding the centralization of decentralized finance (DeFi) surfaced once Uniswap Labs modified the privacy policy on Nov. 17, revealing that it collects publicly-available blockchain data, users' browser data, operative systems data and interactions with its service suppliers.

Adding to the fracas, the hacker behind the FTX exchange thieving of $447 million has been noticed moving their Ether funds. On Nov. 20, the aggressor transferred 50,000 ETH to a separate wallet and converted it to Bitcoin using 2 renBTC bridges.

Traders worry that the hacker could be suppressing Ether's value to profit exploitation leveraged short bets. The rumor was raised by @kundunsan on Nov. 15, even though the Twitter post didn't gain exposure.

Let's look at Ether derivatives data to know if the worsening market conditions have compact crypto investors' sentiment.

Pro traders have been in panic mode since Nov. 10

Retail traders typically avoid quarterly futures thanks to their price distinction from spot markets, however they're skilled traders' preferred instruments as a result of they stop the fluctuation of funding rates that often occurs in a perpetual futures contract.

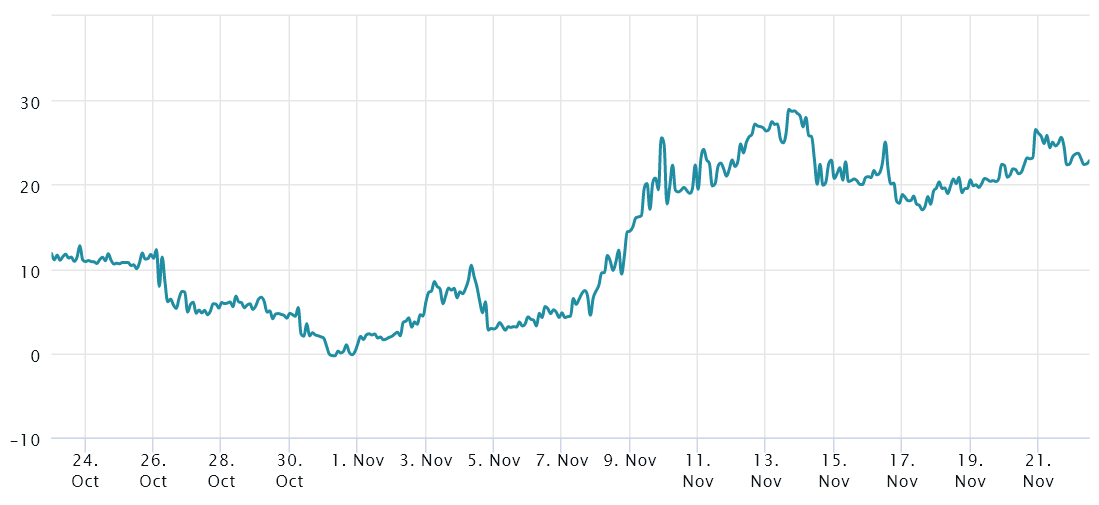

The three-month futures annualized premium ought to trade between +4% to +8% in healthy markets to hide prices and associated risks. The chart on top of shows that derivatives traders are bearish since November. 10 since the Ether futures premium was negative.

Currently there's backwardation within the contracts and this case is atypical and typically deemed bearish. The metric didn't improve once ETH rallied five-hitter on November. 22, reflective skilled traders' temperament to feature leveraged long (bull) positions.

Traders ought to additionally analyze Ether's choices markets to exclude externalities specific to the futures instrument.

Options traders fear additional crashes

The 25% delta skew may be a telling sign once market manufacturers and arbitrage desks area unit overcharging for top side or draw back protection.

In bear markets, options investors provide higher odds for a value dump, inflicting the skew indicator to rise on top of 100%. On the opposite hand, bullish markets tend to drive the skew indicator below -10%, which means the pessimistic place choices are discounted.

The delta skew has been on top of 10% threshold since November. 9, sign that choices traders were less inclined to supply draw back protection. the case worsened over the following days because the delta skew indicator surged on top of 20%.

The 60-day delta skew presently stands at twenty third, therefore whales and market makers are pricing higher odds of price dumps for Ether. Consequently, derivatives knowledge shows low confidence right as Ether struggles to carry the $1,100 support.

According to the data, Ether bulls mustn't throw in the towel simply yet as a result of these metrics tend to be backward-looking. The panic that followed FTX's bankruptcy and therefore the future liquidity problems at Genesis would possibly dissipate quickly if exchanges public proof of reserves and institutional investors addingBitcoin exposure throughout the dip are interpreted as positives by market participants.

( Marcel Pechman, Cointelegraph, 2022 )